Wärtsilä’s Interim Financial Report January–March 2021

Highlights of January-March 2021

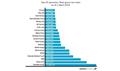

Order intake was stable at EUR 1,244 million (1,247).

Order book at the end of the period decreased by 6% to EUR 5,399 million (5,745).

Net sales decreased by 19% to EUR 946 million (1,170).

- Book-to-bill amounted to 1.32 (1.07)

- Comparable operating result decreased by 28% to EUR 41 million (56), which represents 4.3% of net sales (4.8). This includes approximately EUR 20 million net provisions arising from a detailed project risk review in Wärtsilä Energy.

- Operating result decreased by 30% to EUR 36 million (52), which represents 3.8% of net sales (4.5)

- Earnings per share decreased to 0.04 euro (0.05)

- Cash flow from operating activities increased to EUR 67 million (42)

WÄRTSILÄ'S PROSPECTS

Wärtsilä expects the near-term demand environment to be somewhat better than that of the corresponding period in the previous year. However, visibility remains limited, and the prevailing market conditions make the outlook uncertain.

HÅKAN AGNEVALL, PRESIDENT AND CEO

“During the first quarter of 2021, the prolonged COVID-19 pandemic continued to pose challenges to our business operations, our people, and our financial performance. The cruise industry remained depressed, customers held up investments in new power plant capacity, deliveries were delayed, and profitability remained low due to cost inflation and fixed cost under absorption. However, there were signs of stabilisation and recovery. Vessel ordering activity in general improved, and the demand for services and energy storage solutions was at a good level. As a result, our order intake remained stable compared to the first quarter of 2020, despite the pandemic having a larger impact during the first quarter of 2021. Vaccination programmes are ongoing in many countries, although at varying speeds. This makes us cautiously optimistic about further recovery in the marine markets, while recovery in many of our core energy markets is expected to take longer. Furthermore, our firm focus on working capital resulted in yet another quarter of positive cash flow development. It is of utmost importance to maintain cost control and preserve cash in order to maintain a strong position in the low-demand markets. We will continue to carefully consider our capacity needs and adjust if and where needed.

We have several exciting R&D and strategic projects ongoing, both in-house and together with our partners. These are aimed at accelerating the decarbonisation of the energy and marine industries. During the quarter, we announced that we are installing a pilot plant in Norway to test our carbon capture and storage technologies, and we launched further cost-optimised grid balancing technology capable of ramping up to full load in two minutes. In addition, we are co-operating with several stakeholders in Finland with the aim of utilising emission-free hydrogen in power production, industry, and traffic applications. We also established a strategic partnership with Ocean Technologies Group to enhance safety and efficiency in the maritime sector by combining on-demand digital training, virtual and simulation events via cloud-based solutions, and in-person learning experiences.

In the era of rapid development of new technologies, our starting point will be how we best can make our customers more successful. We will focus on open innovation, services, and cooperation with an end-to-end perspective. Embracing new ideas and sharing best practices will be key, with the ambition to learn something new every day. The technological changes taking place in both of our end-markets during this decade will be more extensive than anything seen during the past 30 years and will result in significant opportunities for Wärtsilä. I believe that with our customer-oriented and innovation-driven culture, leading technologies, highly skilled people, and extensive service network, we are well positioned to harvest on those opportunities.

Visibility into demand development remains low, as the market environment continues to be challenging and unpredictable. We expect the near-term demand environment to be somewhat better than that seen a year ago. Despite our cautious market outlook, we believe that the increasing demand for efficiency and alternative fuels, the digital transformation, and changing energy needs will work in our favour over the long term. In order to maintain our technological leadership, we will continue to invest in developing our fuel flexible solutions and digital offering.”

Full report here https://news.cision.com/wartsila-corporation/r/wartsila-s-interim-financial-report-january-march-2021,c3328376

Apr 22 2021